Invest in high-margin, innovation-led ventures in Bangladesh’s Fashion Manufacturing Industry

Access to high-margin, innovation-led ventures/startups. Accelerating growth toward a $60B future by 2032.

We connect investors with vetted startups aligned to innovation and sustainability.

WHY RMG ANGELS IS THE BEST ANGEL NETWORK TO JOIN.

A Proven Industry, Repositioned for Higher Returns

The Ready-Made Garments sector is Bangladesh’s most resilient and return-generating industries. RMG Angels enables investors to participate in its future-ready opportunities, rather than traditional low-margin manufacturing exposure.

HNI's Prefer the Network Because;

ANGEL ESSENTIALS

“We are looking for patient capital that understands the long-term transformation of Bangladesh’s most vital industry.”

GET TO KNOW OUR SECTORS

Targeting the most promising innovations across the value chain.

Sector Focus

Circular Economy

Sector Focus

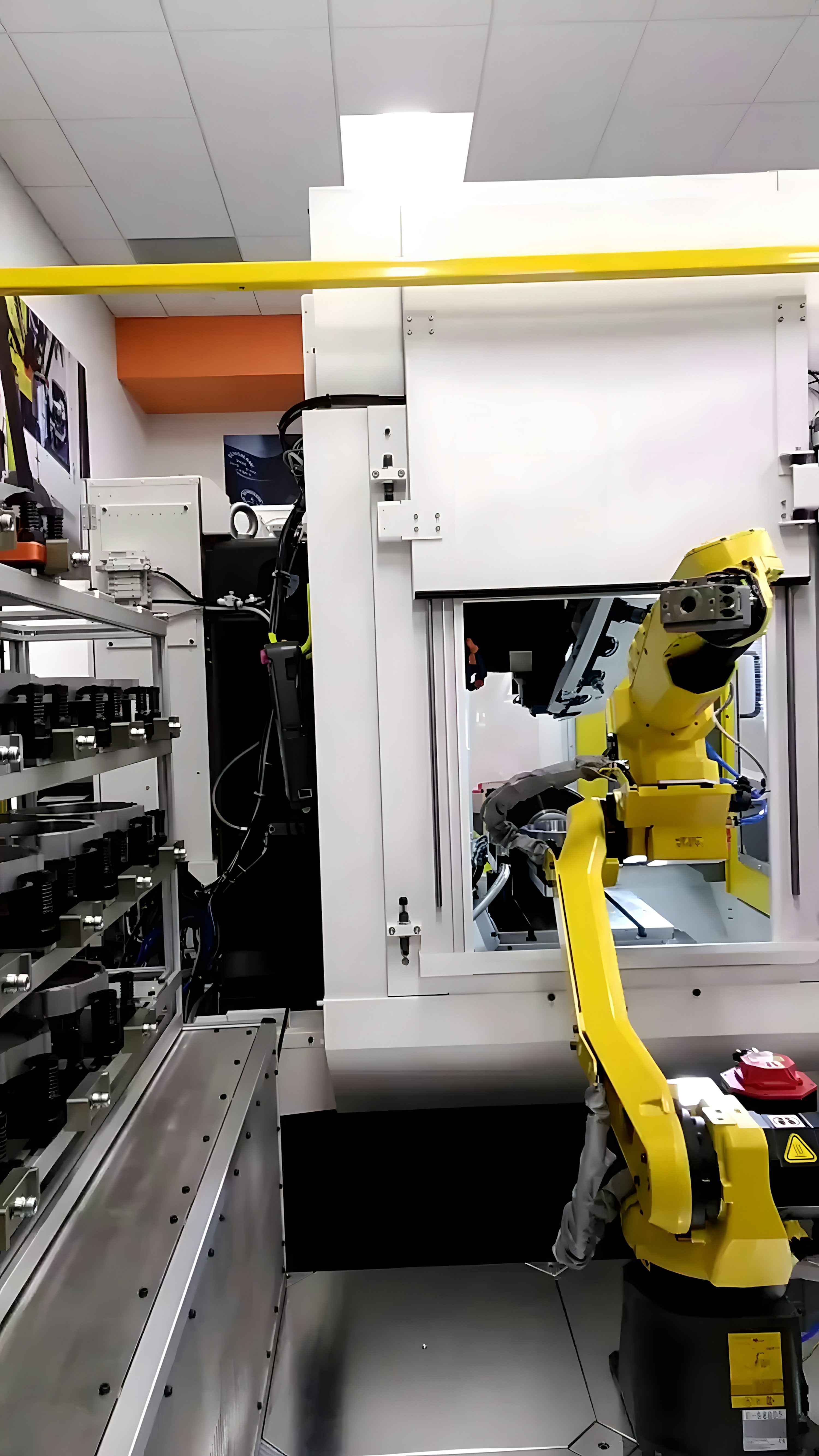

Assistive Technology

Sector Focus

Dyeing & Finishing

Sector Focus

RMG Linked Agriculture

MADE FOR EACH OTHER. STARTUPS AND RMG ANGELS.

Comprehensive support to accelerate growth and market entry.

Startup Selection Process

How we identify and prepare ventures for the angel network.

Startup Selection

Incubation Entry

Startup Selection

Initial Screening

Startup Selection

Team Assessment

Startup Selection

Impact Evaluation

Startup Selection

Due Diligence

Startup Selection

Member Review

UNLOCK THE WORLD OF LONG TERM VALUE CREATION.

A structured approach to sourcing, evaluating, and supporting ventures—designed for governance, execution, and measurable outcomes.

Join the network or apply for investment

Whether you’re an angel investor or a founder, we’ll guide you through a clear, structured process.